The Financial Impact of COVID on New Grads

COVID has had far-reaching consequences for students and new grads. How can you bounce back?

Without a doubt, the coronavirus pandemic continues to affect us all. We'll always remember the year we spent in and out of national lockdowns. People have lost work, missed school, and been unable to see friends and family — all while dealing with the worries of a global pandemic.

While there has been a sense of national unity during this period, everyone's experience will be different. And for younger people, the pandemic has presented challenges unique to their age and stage in life. Teenagers and young adults are often at crucial milestones — such as finishing school, starting further education, getting a first job or moving away from home.

While there's no 'right' age to tick off these accomplishments, having your progress halted by a pandemic was a pretty new challenge for a generation to deal with. COVID-19 has affected young people in several ways, including:

Education

For anyone in school, college or university, 2020 was a disruptive year. Schools were closed, classes moved online, and exams were postponed.

While it might be great fun to miss a day or two of school — with a snow day, for example — there's quite a lot of pressure while you're in education. Whether that's completing coursework or preparing for your exams, having interaction with teachers and other students makes studying easier.

During large parts of the pandemic, many students were stuck at home on their own dealing with quite a few uncertainties — when they'd be able to return to school, when they'd be taking their exams and so on.

Young people had to adapt quickly to online learning. Although this will have helped with the amount of school missed, it's definitely been a cause for concern amongst the younger population. Research released by the British Science Association (BSA), in collaboration with One Poll, revealed the top fear amongst young people is the impact of COVID-19 on their education, exams and qualifications. 81% of the 1,000 14-to-18-year olds sampled across the UK were "very or somewhat concerned."

For university students, there's also the costs involved. You pay for your degree and your accommodation, so for students getting limited in-person learning opportunities, it's easy to see how frustrations would build. What's more, part of the appeal of going to university is the experience. Limited social interaction or opportunities to go out would have affected how students spent their free time. With online studying the norm, many students would have moved home.

Jobs

Young people have been among the hardest hit by job losses as a result of the pandemic. They often have jobs that fit around education, which tend to be lower paid or temporary employment. And these have been in sectors most affected by coronavirus — for example, in hospitality or in the gig industry.

According to 2019 OECD data, 35% of young people (aged 15-29) are employed in low-paid and insecure jobs on average across OECD countries, compared to 15% of middle-aged employees (30-50) and 16% of older workers (aged 51 and above).

As a result, young people would have faced a higher risk of job and income loss because of COVID-19. Indeed, further OECD data from early on in the crisis confirmed that young people (15-24) were the group that was most affected by the rise in unemployment between February and March of 2020.

That said, the BSA data found that 73% of 14-to-18-year olds expressed concerns about the impact that COVID-19 will have on their future career. Of course, the impact of job losses or future unemployment will vary depending on age and circumstances. But most young people want to work. A first job or starting a career is an exciting time. Typically you wouldn't have to worry about the industry you're going into or the types of jobs you'd like to do. But more than ever, it feels important to have a secure status in the job market.

Socializing

Everyone thrives in the company of friends and family. It's so important for young adults to be able to meet new people, socialize with their friends, and do all the things they love. Having an active social life makes us feel good about ourselves.

People quickly started organizing other ways to have fun with their friends. Virtual quizzes and games were popular, for example, and we relied on things like cooking, exercise and TV, and film to cope. People can always keep in touch with messages and video calls too.

The younger generation are probably better at keeping in touch online, and everyone did make a huge effort to reach out to friends and family. They're not only a huge source of support and reassurance, but it's just great fun to have a laugh and a joke with other people. During the pandemic, it's been important to still be able to enjoy yourself.

But socializing online isn't quite the same. You only have to see how excited people get about rules relaxing in order to see how much people enjoy social interaction — even if it's restricted to a group of six.

Mental wellbeing

The COVID-19 pandemic has affected people's wellbeing. You could have been worried about older relatives. Or struggled without much interaction with friends. Maybe education was your biggest concern. Whatever it was (or continues to be), you're not alone. It's been a difficult time for everyone.

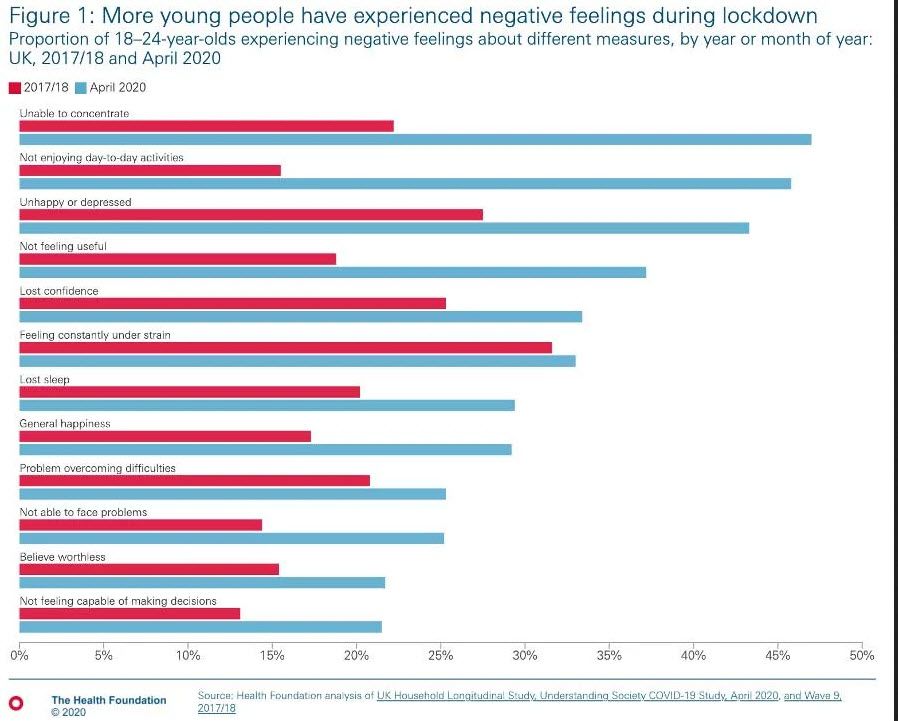

For the younger population, the proportion of 18-24 year-olds experiencing negative feelings did rise. The Health Foundation compared Understanding Society data from 2017/18 and April 2020. It showed that young people are three times more likely to report that they were not enjoying day-to-day activities in April 2020 than they were in 2017/18. There is also a significant increase in the number of young people reporting other negative feelings, as shown in the graph below.

The financial impact of COVID-19

Understandably, the immediate concern of coronavirus was everyone's health and safety. But as things progressed, you started to hear more about the knock-on effects of the country being locked down for months at a time — mainly around people's finances. There are both current challenges for household finances, and worries about the longer-term impact on the economy and job market.

ONS data from June 2020 revealed that among those who were worried about the impact COVID-19 was having on their lives, those aged 16 to 29 years were significantly more likely to report an impact on their household finances (30%) than those aged 60 years and over (13%). The top two impacts for those aged 16 to 29 years were:

- A reduction in income (84%)

- Being unable to save (38%)

Ultimately, younger adults will be living with the financial impact of COVID-19 for longer. Losing out on income and not having any money spare to put away is worrying. You build the foundations for a healthy adulthood when you're younger. And making a smooth transition from being a teenager to a young adult often depends on things like access to education, work and support — these are all areas COVID-19 has impacted.

But it's not all doom and gloom. Young people are optimistic and resilient, with the ONS data showing that over half of them (55%) reported they expect their lives to return to normal within six months. Although we do still face challenges, it's great to see that young people have that positive outlook. ONS data also suggests younger people (16 to 29) are both more likely than those aged 60 years and over to say they expect the financial position of their household to get better, and less likely than those aged 30 to 59 years to say they expect it to get worse.

Advice on tackling longer term challenges for young adults

It's been a scary time. But there has also been some unexpected, positive changes as a result of lockdown. For young people, it was a chance to slow down from a hectic life juggling studying, work and a busy social life. After facing any challenge, it's important to remind yourself of how far you've come.

If you can start to learn to do the following while you're young, you'll feel more capable in dealing with anything life throws your way.

- Be proud of yourself. The past year or so hasn't been easy — but you've made it through everything so far. It's important to acknowledge that and be proud of yourself.

- Recognize your achievements. Rather than focusing on what you've been unable to do, look at what you've managed to do despite any difficulties. For example, you might have spent more time with family or learnt to love walks again. Celebrating achievements, no matter how small, is a useful skill.

- Prioritise your own wellbeing. It's easy to forget about yourself when lots of stressful things are going on around you. But during difficult times it's more important than ever to prioritise your wellbeing. All the things people have been saying to do during the pandemic — slow down, exercise, eat well, connect with friends and so on — are things you should always prioritise.

- Have a plan (but be patient with setbacks). Going forwards, of course you should be thinking of your future and making plans. But if COVID-19 has taught us anything, it's that you can't plan for every eventuality. Don't get frustrated — you have a lot of time to achieve your goals.

- Acknowledge the journey. The transition between childhood and adulthood isn't a simple one. It probably won't go as planned. But you'll learn a lot, create new connections, establish a career and more.

Now is a great time to set yourself up for a successful future. In order to face the financial uncertainties COVID-19 may create for a while, one of the things you can do is take time to learn valuable money management skills, such as:

- Budgeting. To be able to budget, you need to know your regular incomings and outgoings. Then you'll be able to set yourself a budget of how much you should be spending each week. There are apps and tools to help you do this. You might find it quite revealing what you end up spending your money on.

- Saving. You can't plan for everything. But you can certainly prepare yourself a little financially. Where possible, try to save money — whether that's for a rainy day or to save towards a goal. You could start by using these saving tactics:

- At the start of the month. If you wait until the end of the month, you might not have anything left to save. Instead, you can include your savings in your budget and move the money to a savings account as soon as you're paid.

- Rounding up. Certain apps will automatically round up each time you spend, so you can save without really noticing.

- Weekly increases. There are plenty of savings challenges to try — for example, the 52 week challenge. During the first week, you save $1. The second, $2 and so on. Within a year, you'll have $1,378.

Check out the full guide