10 Ways to Make the Most of your Student Finances

Between tuition fees, rent and an ever-growing schedule of costly social events, becoming financially responsible as a student can feel like an insurmountable challenge. The following tips will help you conquer your budget battles and work towards a more financially secure life.

- 1. Track your spending to eliminate unnecessary expenses

Monitoring your spending will help you pinpoint and eliminate, or at the least, reduce, unnecessary expenses – such as daily $3 coffees that can easily be prepared at home. Avoid letting seemingly insignificant expenses to chip away at your bank account.

- 2. Set realistic financial goals and budget accordingly

A budget that fails to account for expenses such as the occasional night out, or your weekly coffee excursions, is unlikely to provide a realistic financial goal. Design a budget that takes into account obligatory expenses – such as bills – and leaves room for the occasional treat. The road toward financial success requires being selective with your indulgent spending, rather than cutting it out entirely. Consider downloading an app such as Fudget to help you track and allocate your expenses.

- 3. Create visual reminders of your long-term financial goals

Reminding yourself of the financial goals you aspire to achieve is a powerful motivator to reduce unnecessary spending. Consider sticking photos of a destination you hope to travel to on your fridge, or creating a Pinterest board filled with photos of your dream home.

- 4. Take advantage of coupons and sales

Before you shop, make a list of items you’d like to buy and scour the Internet or the flyers on your doorstep to find the best deals. Flipp is an app that contains a catalogue of virtual flyers, customized based on the user’s location. You can use the app to price match, compare costs, and help you maximize your saving.

- 5. Be honest about your financial situation with others

Strive to be candid about your financial situation – particularly when turning down invitations to expensive social events. Attending every brunch you’re invited to can take a significant toll on your bank account.

- 6. Make a list of free activities to enjoy

Being financially responsible doesn’t require you to sacrifice your social life. The next time you’re tempted to make plans at an expensive bar, consider a free option, such as hiking in a local park, inviting friends to enjoy a movie night at home or visiting a museum during its free hours.

- 7. Create a gratitude journal

Take a few minutes each day to write down what you’re particularly grateful for, such as your circle of friends, your health, and your family. Exercising gratitude will help you focus on your blessings and resist the urge to seek happiness in impulsive spending.

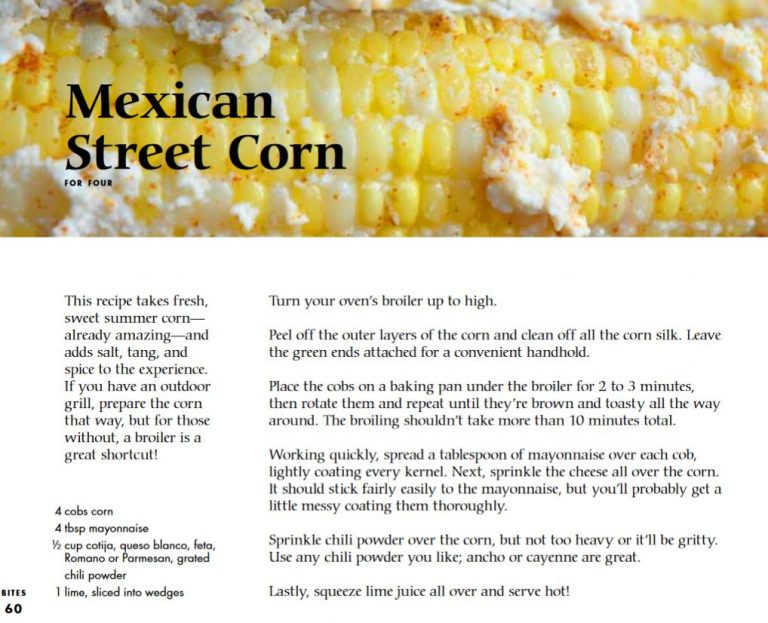

- 8. Learn to cook and prepare meals beforehand

Home-cooked meals are significantly cheaper, and often healthier, than eating out. Explore Tasty (which is also available as an app) for delicious new recipes you can prepare the next time you’re tempted to order takeout. Or try Leanne Brown’s Good and Cheap cookbook, which is free as a pdf. Do some of the prep in advance if you can so it’s easy to throw a meal together when you come home tired or pressed for time.

From Leanne Brown’s Good and Cheap

- 9. Consider a “cash-only” challenge

For an extra challenge to help you stay within your budget, forego your debit and credit cards and leave the house with cash in precisely the amount you’ve permitted yourself to spend. You can’t overspend if you don’t have the money to do so!

- 10. If you overspend, reflect on it and adjust your future goals

If you find yourself exceeding your budget, take time to think over any mistakes, determine what went wrong, and, if necessary, adjust your budget. Forgive yourself and treat your mistakes as an opportunity to reassess your spending habits and goals.

By Maha Ansari, BJ 2016 (Carleton)

account_balanceMore About This School